Bitcoin, a digital currency, is gaining popularity in many regions, including the one using Naira. This guide explores the world of mobile applications that make it easier than ever to buy Bitcoin using Naira. We’ll delve into various apps, their security measures, transaction fees, and overall user experience.

Navigating the cryptocurrency landscape can be daunting. This comprehensive guide demystifies the process of buying Bitcoin with Naira, providing a step-by-step approach to help you understand the nuances of this emerging financial technology. We’ll also discuss alternative methods and the regulatory environment.

Introduction to Bitcoin Purchasing with Naira

Bitcoin, a decentralized digital currency, operates independently of central banks. Its value fluctuates based on supply and demand, making it a volatile but potentially lucrative investment. Bitcoin transactions are facilitated through a secure, peer-to-peer network, without intermediaries. This contrasts sharply with traditional financial systems, which rely on banks and other institutions.The use of Naira, Nigeria’s official currency, for Bitcoin purchases offers residents a means to access and participate in the global cryptocurrency market.

This accessibility is significant given the increasing popularity of Bitcoin and other cryptocurrencies in the region. Mobile applications have become crucial tools in enabling these transactions, making the process more convenient and accessible to a wider range of users. This approach streamlines the buying and selling process, allowing for seamless interactions within the digital realm.

Understanding Bitcoin

Bitcoin’s value is determined by market forces, with factors like adoption rates, regulatory changes, and technological advancements influencing its price. Its decentralized nature means no single entity controls its supply or value. Bitcoin’s unique characteristic is its cryptographic security, which ensures the integrity and immutability of transactions. This system of validation, through complex algorithms, provides a transparent and secure record of all transactions.

Cryptocurrency Transactions

Cryptocurrency transactions utilize a decentralized ledger, known as a blockchain, to record and verify transactions. This blockchain technology allows for transparency and security, with every transaction permanently recorded. Cryptocurrency transactions are often faster and cheaper than traditional financial transactions, particularly when conducted internationally. However, the volatility of cryptocurrency values necessitates careful consideration and risk management.

Significance of Naira for Bitcoin Purchases in Nigeria

The use of Naira for Bitcoin purchases in Nigeria provides Nigerians with a way to access a global financial system, enabling cross-border transactions and potentially diversifying their investment portfolios. This can be particularly important for those seeking alternative investment avenues or those engaged in international trade. The availability of Naira for Bitcoin transactions has also led to a surge in the adoption of Bitcoin and other cryptocurrencies among Nigerian citizens.

Role of Mobile Applications

Mobile applications play a crucial role in facilitating Bitcoin purchases with Naira. These applications offer a user-friendly interface, simplifying the process of buying and selling Bitcoin. They often provide real-time market data, enabling users to make informed decisions based on current pricing. Furthermore, these platforms typically offer security features to protect user funds and transactions.

Bitcoin Purchasing Process Overview

The process of buying Bitcoin with Naira typically involves downloading a dedicated mobile application, creating an account, and linking a Naira bank account. Users can then browse Bitcoin listings, choose a reputable vendor, and initiate a purchase. The process is usually secure and straightforward, guided by the application’s interface. This approach facilitates a smooth transaction process from initiation to completion.

Available Bitcoin Purchasing Apps

Several mobile applications facilitate Bitcoin purchases using Nigerian Naira. These apps have emerged as convenient options for individuals seeking to engage in cryptocurrency transactions within Nigeria’s financial landscape. Their proliferation reflects a growing interest in digital assets and a need for user-friendly platforms for accessing them.

Various Bitcoin Purchasing Apps

Various mobile applications facilitate Bitcoin purchases using Naira. These platforms cater to different user preferences and needs, offering varying degrees of features and security. Understanding the range of available options empowers users to choose the app that best aligns with their individual requirements.

- Coinbase: A popular global cryptocurrency platform, Coinbase offers a straightforward approach to Bitcoin purchasing. Its user-friendly interface and established reputation contribute to its popularity, although it might not be the most cost-effective option for all users.

- Binance: Binance is a leading global cryptocurrency exchange. While offering a wide range of cryptocurrencies, it also facilitates Bitcoin purchases with Naira. Its comprehensive features, including margin trading and staking options, make it suitable for experienced investors, but its complex interface may be challenging for beginners.

- LocalBitcoins: This platform connects buyers and sellers directly, enabling peer-to-peer (P2P) Bitcoin transactions. It allows users to find sellers offering Naira-to-Bitcoin exchange rates directly, potentially providing competitive pricing. However, it requires users to exercise caution in selecting reliable sellers to avoid scams.

- Paxful: Similar to LocalBitcoins, Paxful facilitates P2P Bitcoin trading. It offers various payment methods and a wider selection of sellers, potentially enabling users to find favorable exchange rates. However, it necessitates due diligence in verifying the credibility of sellers and transactions to mitigate risks.

App Feature Comparison

Different Bitcoin purchasing apps offer distinct features. A crucial aspect to consider is the user interface’s intuitiveness and the availability of support. The security measures implemented by each app and the fees associated with transactions are also important factors in the decision-making process.

| App Name | Security | Fees | Usability |

|---|---|---|---|

| Coinbase | High | Moderate | Excellent |

| Binance | High | Variable | Good |

| LocalBitcoins | Variable (Dependent on Seller) | Variable | Moderate |

| Paxful | Variable (Dependent on Seller) | Variable | Good |

Security Measures

Security is paramount when dealing with cryptocurrency transactions. Robust security measures are crucial for protecting user funds and personal information. Features like two-factor authentication (2FA), secure storage, and regular security audits contribute to a safer platform. It is essential to research the security protocols of each app before making a decision.

User Experience and Interface

Bitcoin purchasing apps designed for Naira users often prioritize a clean and intuitive interface. This focus on usability is crucial, as navigating cryptocurrency transactions can be daunting for newcomers. A well-designed app can significantly improve the user experience and build trust in the platform.

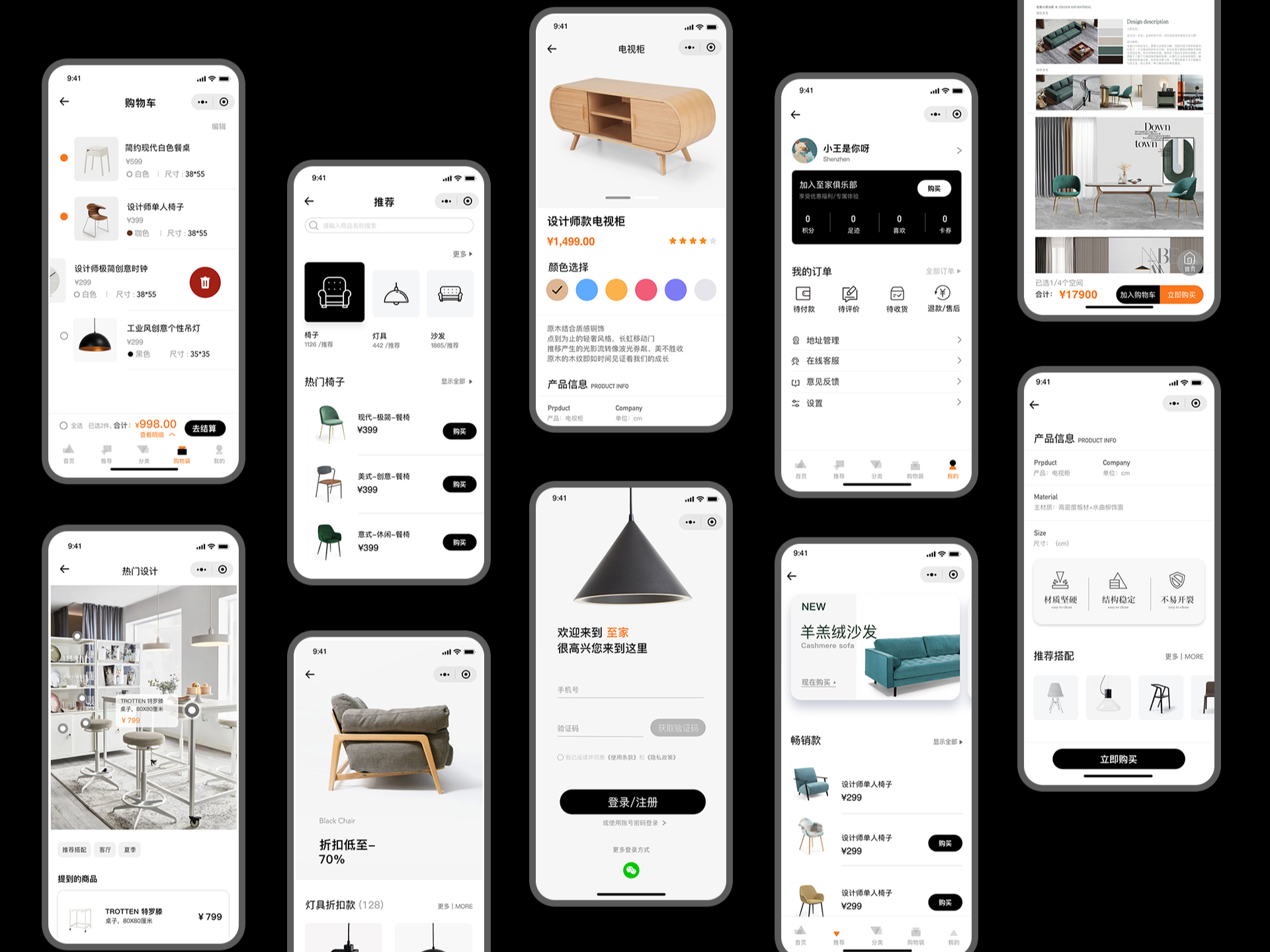

Typical User Interface

The typical interface of a Bitcoin purchasing app for Naira users often includes distinct sections for account management, transaction history, and market information. Users can typically view current Bitcoin prices, exchange rates against the Naira, and recent transaction details. A user-friendly dashboard provides an overview of available balances and pending transactions. Navigation between these sections is usually straightforward and visually clear.

The app’s layout generally adheres to mobile-first principles, ensuring a responsive and optimized experience across various devices.

Ease of Navigation and Transaction Processes

Navigation within these apps is typically intuitive, using clear menus and visual cues. Transaction processes are streamlined, often employing a step-by-step approach to guide users through the process. Interactive elements and progress indicators enhance the clarity and reduce confusion. This focus on a straightforward and understandable transaction process minimizes potential errors.

Account Creation and Verification

Creating an account usually involves filling out a registration form with personal details. The verification process is crucial for security and typically involves providing government-issued identification documents and confirming phone numbers. This verification process helps the app comply with regulations and ensures a safe platform for all users. The verification process is often designed to be quick and user-friendly.

Payment Process with Naira

The payment process for Naira often involves selecting the desired amount of Bitcoin, confirming the transaction details, and entering the payment information. Users typically choose their preferred payment method, such as bank transfer or mobile money platforms. The app often displays clear instructions and confirmation steps throughout the process. This transparent approach reduces the risk of misunderstandings and ensures the user is aware of the transaction details before proceeding.

Avoiding Common Pitfalls

The user interface of Bitcoin purchasing apps can significantly mitigate common pitfalls in cryptocurrency transactions. By clearly displaying exchange rates and transaction fees, the app can help users make informed decisions. Secure payment gateways and multi-factor authentication enhance the safety of transactions. Comprehensive transaction histories allow users to track and monitor their transactions, promoting transparency and accountability.

Transaction Fees and Payment Methods

Bitcoin purchases with Naira often involve fees, which vary based on the payment method and the platform used. Understanding these fees is crucial for budgeting and ensuring a smooth transaction. Different payment methods also have varying levels of accessibility, impacting the ease of initiating a purchase.

Transaction Fees

Transaction fees are a crucial aspect of Bitcoin purchases. These fees cover the cost of processing the transaction on the Bitcoin network and are typically expressed as a percentage of the transaction amount. The fees themselves are often influenced by factors such as network congestion. High network congestion might lead to higher transaction fees. Conversely, low congestion often results in lower fees.

Payment Methods

Various payment methods are used for buying Bitcoin with Naira. Each method presents a unique combination of convenience, security, and associated costs. The accessibility of these methods can also vary considerably.

Bitcoin Purchase Initiation with a Naira Bank Account

Initiating a Bitcoin purchase using a Naira bank account typically involves several steps. These steps often include selecting the desired Bitcoin amount, confirming the payment details from the bank account, and then completing the purchase process on the platform.

Payment Method Breakdown

| Payment Method | Fees | Availability |

|---|---|---|

| Bank Transfer | 0.5-2% | High |

| Mobile Money Transfer | 1-2% | High, particularly in regions with established mobile money infrastructure |

| Crypto-to-Crypto Exchange | 0-1% | Moderate, usually involving a conversion step to Naira first |

| Peer-to-Peer (P2P) Platforms | Variable, often lower than bank transfer | Moderate, typically involves an intermediary step, and may require more diligence in security |

Note: Fees can vary between platforms and are subject to change. The availability of a payment method also depends on the specific app or platform you are using.

Security Considerations for Bitcoin Purchases

Protecting your funds when buying Bitcoin with Naira is paramount. A secure platform and responsible user practices are essential for a positive and safe experience. Understanding the potential risks and implementing proactive security measures will help mitigate these risks and ensure a smooth transaction process.

Mobile Application Security

Robust mobile applications are crucial for secure cryptocurrency transactions. These applications should incorporate industry-standard security protocols to safeguard user data and funds. The platform should employ encryption to protect sensitive information during transmission and storage. Regular security audits and updates are also vital to identify and address vulnerabilities proactively. This approach is essential for maintaining user trust and preventing unauthorized access to accounts.

Importance of Strong Passwords and Two-Factor Authentication

Strong passwords and two-factor authentication (2FA) are fundamental security measures for protecting user accounts. A strong password should be unique, complex, and difficult to guess. It should contain a combination of uppercase and lowercase letters, numbers, and symbols. 2FA adds an extra layer of security by requiring a second verification method, such as a code sent to a mobile phone or an authenticator app, in addition to the password.

This multi-layered approach significantly reduces the risk of unauthorized access.

Safeguarding User Accounts

Maintaining a secure account involves several best practices. Regularly reviewing account activity for suspicious transactions is critical. Users should be cautious about clicking on unknown links or downloading attachments from untrusted sources. Keeping the mobile application updated with the latest security patches is also important. Users should avoid sharing their login credentials with anyone, and promptly report any suspected security breaches to the platform administrators.

Strong password management practices are vital to protecting user accounts.

Potential Risks and Vulnerabilities

Potential risks associated with using Bitcoin purchasing apps include phishing attacks, malware infections, and social engineering tactics. Phishing attacks attempt to trick users into revealing their login credentials or other sensitive information. Malware infections can compromise devices and steal data. Social engineering attempts exploit human psychology to manipulate users into revealing personal information. Users should remain vigilant and skeptical of unsolicited requests or suspicious messages.

Regular security awareness training can help mitigate these risks.

Transaction Verification

Double-checking transactions is crucial. Users should meticulously review every transaction before confirming it to prevent accidental or fraudulent charges. Detailed transaction records should be kept for reference. Users should also monitor their account balances regularly to identify any unauthorized activity. This proactive approach significantly reduces the risk of financial loss.

Buying Bitcoin – General Information

Bitcoin, a decentralized digital currency, is purchased and sold through various methods, offering a pathway to participate in the global cryptocurrency market. Understanding these methods and the history behind Bitcoin is crucial for informed decisions when considering its acquisition.Acquiring Bitcoin involves more than just exchanging fiat currency; it necessitates understanding the underlying technology and the potential risks involved. This section details the process, historical context, and motivations behind Bitcoin purchases.

Methods of Acquiring Bitcoin

Various methods exist for obtaining Bitcoin. These methods range from traditional financial exchanges to more specialized platforms. Understanding these options helps individuals choose the most suitable approach for their needs.

- Exchanges: Centralized exchanges, such as Coinbase and Binance, facilitate the buying and selling of Bitcoin using traditional payment methods. Users typically deposit funds into their accounts and then use those funds to purchase Bitcoin at the prevailing market price. These exchanges provide a relatively straightforward and readily accessible way to enter the Bitcoin market.

- Over-the-Counter (OTC) Markets: OTC markets allow for direct transactions between buyers and sellers. This often involves more complex negotiations and potentially higher transaction fees. OTC platforms are frequently used for larger transactions and may provide more personalized service but usually require more due diligence and trust.

- Bitcoin ATMs: Bitcoin ATMs allow for the purchase of Bitcoin using cash. This method provides a convenient alternative for those who prefer not to use traditional banking systems. However, Bitcoin ATMs may have higher transaction fees and may not always offer the best exchange rates.

- Peer-to-Peer (P2P) Platforms: P2P platforms connect buyers and sellers directly, allowing for transactions outside of traditional exchanges. These platforms can be a good option for those seeking flexibility and potentially better exchange rates. However, users need to be wary of scams and carefully evaluate the security of the platform and the seller.

History and Evolution of Bitcoin

Bitcoin emerged in 2009, initially as a decentralized digital currency. Its history is characterized by periods of significant growth and volatility, often tied to technological advancements and regulatory developments. Early adoption was driven by a desire for a financial system independent of central banks.

- Early Days (2009-2017): Bitcoin’s early years were marked by low adoption and significant price fluctuations. The technology was relatively nascent, and understanding of its potential was limited. Early adopters were often driven by the idea of a decentralized currency.

- Growth Phase (2017-2021): This period saw a surge in interest and adoption of Bitcoin. Factors such as increased media coverage, institutional investment, and technological advancements fueled this growth. The prices of Bitcoin soared during this time.

- Regulation and Volatility (2021-Present): Growing regulatory scrutiny and global economic factors have influenced Bitcoin’s price and adoption. Increased regulation has led to both opportunities and challenges for Bitcoin investors. Bitcoin’s price remains volatile and is subject to significant fluctuations.

Reasons for Purchasing Bitcoin

Several factors motivate individuals to purchase Bitcoin. These motivations often stem from a desire for financial freedom, investment opportunities, or a belief in the currency’s long-term value.

- Investment Potential: Bitcoin is often seen as an investment asset with the potential for significant returns. Its decentralized nature and limited supply make it an attractive option for some investors.

- Financial Freedom: Bitcoin offers a way to transact outside traditional financial systems. This appeals to those seeking greater control over their finances and a way to circumvent certain financial regulations.

- Portfolio Diversification: Including Bitcoin in an investment portfolio can help diversify risk. Its performance is often uncorrelated with traditional assets, making it a potential hedge against economic uncertainty.

- Speculative Gains: The potential for significant price appreciation attracts speculative investors who seek to profit from short-term price fluctuations.

Bitcoin’s Role in the Global Financial System

Bitcoin’s role in the global financial system is evolving, though it remains a relatively small part of the overall market. While its impact is still being evaluated, its decentralized structure and potential to disrupt traditional finance are factors to consider.

- Decentralization: Bitcoin’s decentralized nature is a key feature. It operates without a central authority, offering a potentially more resilient and democratic alternative to traditional financial systems.

- Global Accessibility: Bitcoin can facilitate transactions across borders without the limitations of traditional banking systems. This can be beneficial for international trade and remittances.

- Technological Innovation: Bitcoin’s underlying technology, blockchain, has the potential to be applied to various sectors beyond finance. This creates opportunities for innovation in areas such as supply chain management and voting systems.

- Risk Assessment: Bitcoin’s price volatility and regulatory uncertainties remain significant factors for potential investors and users. The impact of regulation and global economic factors on its future trajectory requires ongoing analysis.

Regulatory Landscape and Legal Aspects

The regulatory landscape surrounding Bitcoin purchases in any region is complex and constantly evolving. Navigating these regulations is crucial for both buyers and sellers to avoid potential legal issues. Understanding the legal implications of using Bitcoin and Naira in transactions, alongside compliance regulations for cryptocurrency, is vital for a secure and legitimate purchasing experience. This section Artikels the key aspects of the regulatory environment and the associated risks.The legal status of Bitcoin and other cryptocurrencies varies significantly across jurisdictions.

Some countries have embraced cryptocurrencies with specific regulations, while others remain hesitant or have no clear framework. This uncertainty can create ambiguity and potential legal risks for users involved in Bitcoin transactions. The specific regulations of a region will directly impact the feasibility and safety of using Bitcoin alongside Naira for transactions.

Regulatory Framework for Bitcoin Purchases

Various jurisdictions have introduced regulatory frameworks concerning cryptocurrency. These frameworks aim to balance the potential benefits of cryptocurrencies with the need for investor protection and financial stability. This includes the need to address issues of money laundering, terrorist financing, and market manipulation. Regulations can include licensing requirements for exchanges, Know Your Customer (KYC) procedures, and reporting obligations.

Legal Implications of Bitcoin and Naira Transactions

Using Bitcoin and Naira in transactions can have legal implications that vary depending on the specific laws of a region. For instance, in some jurisdictions, the use of Bitcoin might be considered a financial instrument, subject to different tax regulations. Other regulations may address the treatment of Bitcoin as property or a digital asset, which might have implications for ownership, transfer, and inheritance laws.

Understanding these implications is crucial for avoiding potential legal issues.

Compliance Regulations for Cryptocurrency

Compliance with regulations for cryptocurrency transactions requires adherence to several rules. These rules often focus on issues such as anti-money laundering (AML) and combating the financing of terrorism (CFT). Cryptocurrency exchanges and businesses handling Bitcoin transactions are frequently subject to these compliance requirements. Specific regulations will often mandate KYC procedures to verify the identity of users, as well as transaction reporting to the relevant authorities.

Potential Legal Risks and Challenges for Users

Potential legal risks for users include non-compliance with regulatory requirements, tax liabilities, and disputes related to transactions. For example, failing to comply with KYC procedures could result in penalties or legal action. Users must carefully consider the legal implications of Bitcoin purchases before engaging in transactions. Furthermore, disputes arising from transactions, such as fraudulent activities or disagreements over ownership, could lead to legal challenges.

Tax Implications

The tax treatment of Bitcoin transactions can differ significantly depending on the jurisdiction. Some regions might classify Bitcoin as a capital asset, while others might categorize it as a commodity or currency. It’s crucial for users to understand the tax implications associated with Bitcoin purchases and sales in their region, as non-compliance could result in penalties. Consultations with financial advisors and tax professionals are recommended to navigate the specific tax regulations applicable to Bitcoin transactions.

Alternatives to App-Based Bitcoin Purchases

Beyond dedicated Bitcoin purchasing apps, several alternative methods exist for acquiring Bitcoin using Nigerian Naira. These alternatives offer varying degrees of convenience, security, and cost, catering to different user needs and risk tolerances.

Peer-to-Peer (P2P) Exchanges

P2P exchanges facilitate direct transactions between buyers and sellers. This often leads to lower transaction fees compared to app-based platforms, as intermediaries are minimized. However, this direct interaction introduces higher risks, including potential scams and disputes. Verification of the seller’s legitimacy and adherence to agreed-upon terms are crucial for mitigating these risks.

Cryptocurrency ATMs

Bitcoin ATMs offer a physical alternative to app-based purchases. They are often located in public spaces, allowing for immediate Bitcoin acquisition. However, they frequently charge higher fees compared to other methods. These fees may also fluctuate depending on the specific ATM operator and the amount transacted. Geographical limitations are another factor to consider.

Online Cryptocurrency Exchanges

Online cryptocurrency exchanges provide a more established platform for buying and selling Bitcoin. These platforms typically have robust security measures, but transaction fees can vary. Users often need to create an account and complete KYC (Know Your Customer) procedures to comply with regulatory requirements. Different exchanges might employ varying fee structures and security protocols, impacting user experience and security.

Table of Alternative Bitcoin Purchase Methods

| Alternative Method | Advantages | Disadvantages |

|---|---|---|

| Peer-to-peer exchange | Potentially lower transaction fees compared to apps; direct interaction with sellers | Higher risk of scams; disputes can be more difficult to resolve; requires careful buyer due diligence |

| Cryptocurrency ATMs | Physical access to Bitcoin; immediate transactions | Higher transaction fees; limited availability; potential for fraud |

| Online Cryptocurrency Exchanges | Established platform; robust security measures; wider range of cryptocurrencies; often support other financial services | Transaction fees; account creation and KYC requirements; potentially more complex user interface |

Future Trends and Projections

Bitcoin purchases with Naira are poised for continued growth, driven by increasing adoption of cryptocurrencies and the evolving financial landscape. Technological advancements and regulatory developments will shape the future of this market, impacting the user experience and overall accessibility. This section explores potential innovations and the projected growth of Bitcoin in the region.

Predicted Developments in Bitcoin Purchases with Naira

The Nigerian market for Bitcoin purchases with Naira is anticipated to experience a surge in demand, mirroring global trends. This is largely due to the increasing awareness and acceptance of cryptocurrencies, and the need for alternative financial instruments. Furthermore, improvements in user interface design and enhanced security measures will likely drive further adoption among Nigerian users.

Potential Innovations in Mobile Applications

The user experience in mobile applications for cryptocurrency transactions will likely evolve towards greater ease of use and security. This will involve features such as simplified transaction flows, real-time price updates, and more secure authentication methods. Integrating blockchain technology directly into these applications will further enhance security and efficiency.

Evolving Role of Cryptocurrency in the Financial Landscape

Cryptocurrencies are gradually integrating into mainstream finance, with increased acceptance from businesses and financial institutions. The potential for cryptocurrencies to act as a store of value and a means of exchange is prompting more robust regulatory frameworks. This evolving role is influenced by the development of decentralized finance (DeFi) protocols and stablecoins, which offer more accessible and potentially less volatile alternatives to traditional finance.

Potential Growth of Bitcoin in a Particular Region

The Nigerian market offers significant potential for Bitcoin growth due to factors such as the high mobile phone penetration rate, the presence of a large and active online community, and the prevalence of remittances. The growing demand for alternative investment options and the need for accessible financial services are additional catalysts. The adoption of Bitcoin in the region will likely be facilitated by the development of user-friendly mobile applications and educational resources.

Successful adoption models from other emerging markets can provide insights and support. For example, the increasing popularity of cryptocurrency exchanges in Southeast Asia, with a strong emphasis on user-friendly interfaces, suggests a pathway for similar growth in Nigeria.

Conclusion

In conclusion, buying Bitcoin with Naira via mobile apps presents exciting opportunities and challenges. Understanding the various apps, fees, security measures, and alternative methods empowers users to make informed decisions. This guide provides a thorough overview to help you navigate this dynamic financial landscape.

Top FAQs

What are the common transaction fees for buying Bitcoin with Naira?

Transaction fees vary depending on the payment method and the specific app used. Some apps might charge a small percentage on each transaction, while others might not charge any fees at all. It’s essential to check the app’s terms and conditions for precise fee details.

Are there any security risks associated with using these apps?

While mobile apps provide a convenient way to buy Bitcoin, security remains paramount. Users should prioritize secure mobile applications, strong passwords, and two-factor authentication. They should also be wary of phishing scams and suspicious links.

What are the different payment methods available for buying Bitcoin with Naira?

Many apps accept bank transfers, mobile money platforms, and sometimes even other cryptocurrency transfers. However, the exact payment options might vary from one app to another. Check the specific app’s list of supported payment methods.

What is the process for creating an account and verifying my identity in these apps?

Generally, the process involves providing personal information, verifying your email address, and often completing a Know Your Customer (KYC) process. The specific steps may differ slightly depending on the app.